Student debt weighs over the dreams of many young people who want to go to college. Students, professors, and lawmakers are all worried about the issue of student debt, as the total amount of unpaid student loan debt in the U.S. has reached $1.6 trillion.

“Is there a problem? Sure. But can we make better choices? Yes.” says Gregory Smedberg, a finance teacher at Hall High School when giving his opinion on student debt. Understanding the reasons for student debt, looking into resources for help, and learning to manage and reduce debt are required skills for those looking into higher education.

Jordan Reinault, a counselor at Hall High School believes, “Education is massively overpriced in general.” Finding a stable and successful job comes with the high price of education. The main cause of school debt for many people is student loans which are often made worse by credit card debt and other financial needs. For borrowers who drop out of school, the weight of student debt can be especially damaging which leaves them with slim chances of ever making a living and an overwhelming amount of debt.

The effects of student debts spread out through families and the whole economy. They go far past the debts of individual borrowers. Student debt could lead to lower consumer spending, delayed goals like owning a home and retirement savings, and limited opportunities in society.“I think it is a problem in America our education system could use a reset as a whole…” says Gregory Smedberg. “…that’s going to require a lot of external work but at the end of the day as students or as people we make smarter financial choices.” The increasing amount of student debt is an urgent concern for society as a whole since it has the potential to worsen already existing prejudice and limit economic growth.

Many programs and resources have been developed as a result of the growing student debt issues to help borrowers manage their financial duties. Certain universities have put in place “no-loan” programs that offer to use grants rather than loans to cover all of an undergraduate’s financial need. The National Consumer Law Center and the Institute of Student Loan Advisors are two groups that provide extensive details and advice on loan forgiveness programs, repayment schedules, and ways out of debt. President Joe Biden is also acting on this problem by canceling public school student debt but not private. Also, advocacy groups such as the Student Borrower Protection Center work to protect borrower rights and shape laws.

Interviews with people who are directly affected by student loan debt, know people who are, and are scared to end up in debt, show the viewpoints and unique experiences surrounding the problem. To reduce student debt, finance teacher Gregory Smedberg highlights the value of financial literacy and making wise decisions by saying, “…specifically in financial literacy we briefly talk about student debt but ultimately in advanced finance and investments student debt we look at the FAFSA.” The financial literacy class is such an important part in shaping these students for the future that “…we’re making it a requirement for the class of 2027 and beyond to take financial literacy.” He advocates for early intervention and practical strategies such as work study opportunities and proactive loan repayment in saying, “You can get a work study opportunity through your school, the money doesn’t go directly to you but it goes to your student loans. It makes going to school cheaper.”

Peter Rosa, a high school student, emphasized the value of giving college decisions serious consideration and expresses worry about the possibility of collecting debt when he says, “I’m carefully trying to decide what school I want to go to because I don’t want to be in a huge amount of debt.” Peter also points out that if in debt, many students are “…not going to be able to afford anything else like going out with friends or getting an apartment and focusing on the things that I need.” He draws attention to the problem that many students encounter when trying to find a balance between their need for education and the burden of debt. Peter believes “…there should be more affordable ways to get into secondary education…” and while community college is an option, it holds students back from being able “…to go out and experience things.”

The importance of budgeting and financial planning is pointed out by counselor Jordan Reinault as a way of preventing excessive debt. He believes it is crucial to have “…a good understanding on where you’re borrowing the money for student loans and knowing your interest rates and how long it’s going to take to pay it back” because “oftentimes students’ parents and guardians don’t have a good understanding they just take on debt.” He doesn’t see it as necessary to go to a college that will put you in debt and recommends exploring other educational options because, “…there’s a lot of options like a community college system which is currently free and it’s a good place to start for a lot of students.” He advises against the risks associated with borrowing too much without having a full understanding of the consequences later in life.

In order to address the main causes of student debt and support borrowers, early actions must be taken as the debt continues to have a significant negative impact on people as well as society as a whole. Through encouraging financial awareness, increasing the availability of affordable education, and pushing for changes in the law, we can work towards a time when the fear of debt won’t prevent people from pursuing higher education. Lastly, by working together and making educated choices, we can make our way through the struggle of student debt and into a more secure financial future.

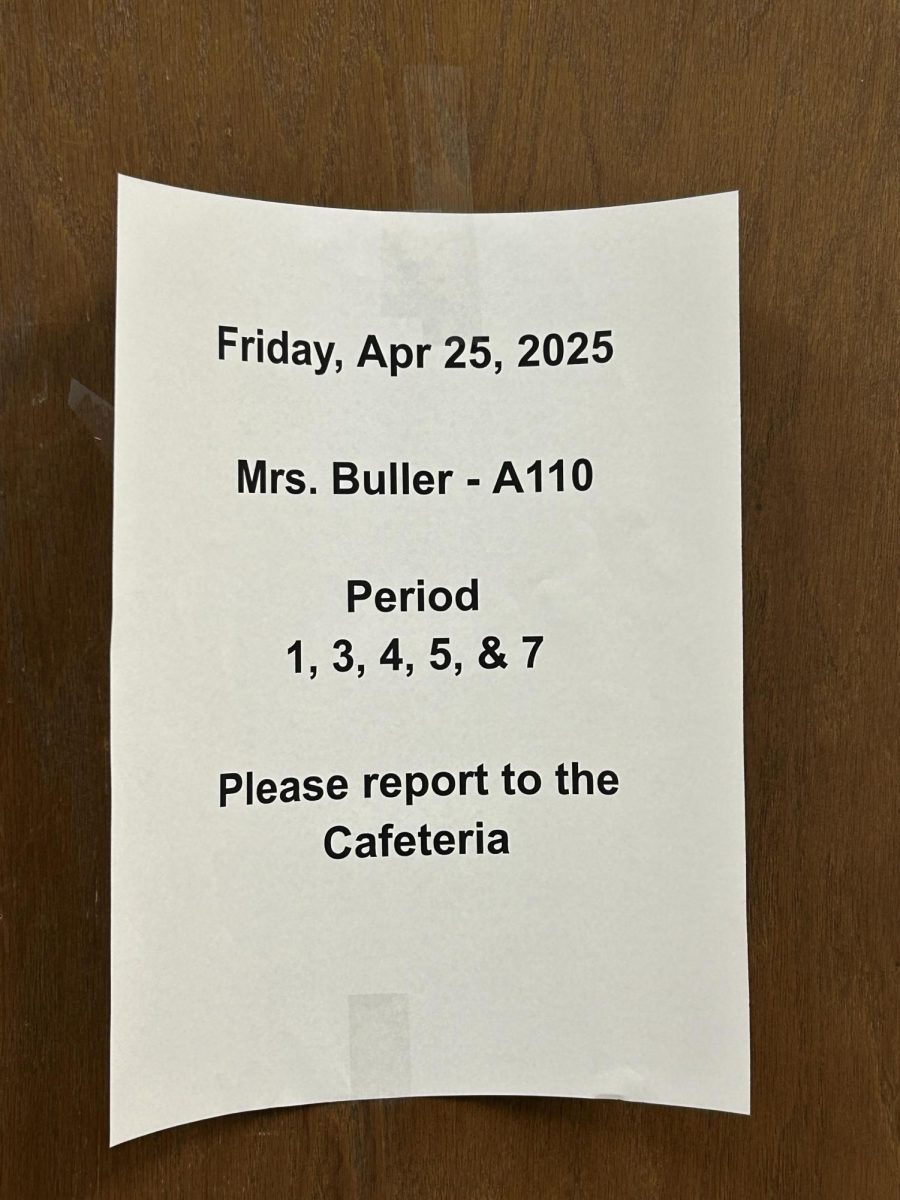

Financial Literacy teacher Gregory Smedberg teaches about how to avoid student debt.