Can Financial Literacy Save the Financial Futures of the Next Generation?

High school students often graduate without possessing the skills to manage their finances, create a budget, and manage their credit score. Education board members in numerous districts have debated whether Financial Literacy, an elective class teaching all of these essential skills, should become a mandatory requirement in school curricula.

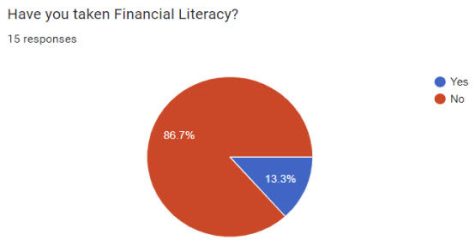

A survey polling 15 students found that 86.7% of respondents had not taken Financial Literacy. Given the lack of financial literacy in schools, students are more prone to make financial mistakes post graduation. CNBC’s Michelle Fox said the results of the 2021 TIAA Institute-GFLEC Personal Finance Index, a survey that tested financial literacy of adults, had an average of 50% incorrect answers. This lack of knowledge is still present in the next generation. When asked, senior Marnie Fronczek said she felt unready to manage her finances after high school: “I don’t understand taxes and how to manage my money.”

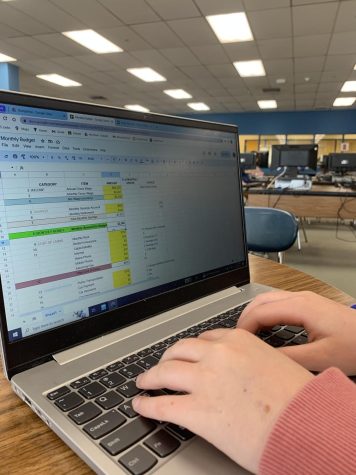

The skills taught in Financial Literacy can help students avoid making detrimental mistakes. Finance educator Gregory Smedberg said, “We take a look at budgeting: types of credit, managing credit, and how important that is as young people to realize that you are using a mini loan every time that you spend on a credit card.” These vital financial skills can immediately be implemented outside of the classroom and have proven to be successful. The National Financial Educators Council said, “A team of researchers surveyed students at 15 geographically diverse colleges to assess financial knowledge and behavior…students whose home states required financial education courses were found to be more likely to save, less likely to make late credit card payments, and more likely to take on a healthy amount of financial risk.” The more students learn throughout high school, the more likely they are to succeed after high school.

Although some school districts do not mandate Financial Literacy, they can encourage students to make educated financial decisions by inviting speakers from programs that are designed to educate future generations. Jordan Gauthier, a member of the Board of Junior Achievement in Northern New England, helps inform and curate a curriculum full of life skills that can be taught to all ages. “Having people in the business community in their city come in and talk to [students] about what they do opens their eyes to different jobs and different opportunities that exist that they might not have known about,” Gauthier said. The classes taught by the Boston chapter of the Junior Achievement Board cover a range of topics, from how to budget, to how your tax dollars fund the fire department.

Despite a percentage of students opting to take Financial Literacy, enrollment is not feasible for all. When asked if she had taken Financial Literacy, senior Kate Healy said, “My mom wanted me to take it, but I couldn’t fit it in my schedule.” The high number of individuals graduating without receiving financial instruction demonstrates the lack of aid students receive when learning about making important financial decisions.